|

| price action trading forex |

|

| price action forex |

also called 'Bullish Bar', which is a bar with a higher high level than the previous high (higher) and the higher level of the previous bass (lower). The sequence of the bar up in the image above shows an upward trend movement. Generally, the closing price of the bar up is higher than the opening price, but it may also be lower as shown in the Black Candlestick bar on the burst bar of the image above. However, the bar is included in the top bar because the highest and lowest level is even higher than the previous bar highs and lows. The bar sequence indicates that at that time the buyers or "the Bulls" control the market.

also called 'lower bar', which is a high level bar that is lower than the previous high (low high) and low level that is also lower than the previous low (lower below). The descending bar in the image above shows a downward trend movement, and indicates that the seller or "the bears" control the market.

Inside Bar is a high level bar that is lower than the previous high and the lower level is higher than the previous low. Many traders think that the bar is the same high or low level as the previous bar as the inner bar. Bar formations like this shows market uncertainty or a state of consolidation where buyers and sellers expect from one another, if it penetrates the highest level of the previous bar, then the buyer wins and vice versa if it penetrates the previous low bar level, then sellers who win and control the market.

Outside Bar is also called the "Mother Bar", which is a bar that "swallowed" inside the bar, or in the engul, the bar formation is the bar that "swallowed" the front bar. In principle, the outer bar is a high level bar that is higher than the previous high bar level or bar thereafter, and the low levels are below the previous low bar level or the bar thereafter. In terms of candlestick, the combination of exterior bars and inside bars is often referred to as "Harami." In the example above the closing level, the outer bar is above its opening level indicating that the buyer controls the market before consolidation.

The price action trading signals from price action reflect the sentiment of market participants, and can give the initial index or direction of the signal for the next price movement.

SIGN IN : FBS

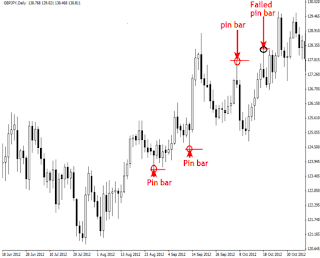

the formation of a pin bar which is a bar with a longer tail (axis) than the body. The longer the tail, the stronger the feeling of rejection at a certain price level. In trend market conditions, pinbars usually insinuated to the reversal movement or the opposite of the current trend, and the pinbar is often referred to as pinbar reversal. Here are some pins for the inversion bar where one of them fails or is a false signal:

|

| price action forex |

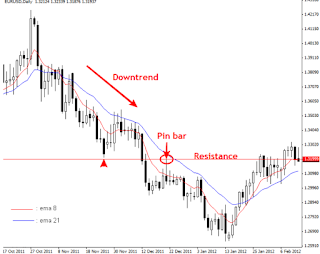

The supporting factors of the price action trading signals to avoid possible errors as in the image above, then The supporting factors that confirm the trading signal of the price action are necessary. Thus, the trader can choose the highest probability signal, which is confirmed by certain support factors. The confirmation or support factor is the level of support and resistance, trend orientation and technical indicators. Frequently used indicators are moving averages to confirm the direction of the trend. Here are examples of trading signals (pin bars) with 3 supporting factors:

|

| price action forex |

Code appears that the formed bar has been confirmed by 3 factors, namely: Trend Direction (downward trend), horizontal line resistance rejection (failed to penetrate resistance), and also rejection by Dynamic Resistance is the area between the exponential moving average (EMA) 21 and the EMA 8 curve indicators. Thus, the probability of entry sale success after pinbar is high. If not in a trend market, conditions consolidate. The common consolidation patterns are laterally (ranging), triangle, Pennant and others.

There are times when the market moves in a narrow range with erratic patterns, this condition is called restless which is difficult to predict and should be avoided.

Here is an example of a trading signal of price action for trend and range conditions: prices cross the lowest level outside the bar which means that the seller is back in market control. It is also supported by the penetration of support levels.

Keyword :

price action trading,price action basics,price action trading course,price action trading strategies pdf

price action trading system,price action patterns,price action setups,price action signalsprice action strategy pdf,price action patterns,price action entry rules,price action indicator,price action easy indicator,price action setups,advanced price action trading pdf,how to master price action tradingPage navigationbbma oma ally advancebbma oma ally advance pdf,bbma oma ally alertbbma oma ally downloadbbma oma ally dashboardbbma oma ally diagrambbma oma ally englishbbma oma ally ebookbbma oma ally entrybbma oma ally eabbma oma ally forex factorybbma oma allyfacebookbbma oma ally formulabbma oma ally fullbbma oma ally full moviebbma omaallyindicatorbbma oma ally instagrambbma oma ally intensivebbma oma ally indonesiabbma oma ally multitimeframebbma oma ally mhvbbma oma ally notesbbma oma ally nota

Tag :

trik

0 Komentar untuk "Important..!! The Basics Of Price Action In Forex Trading "