Price Action from a Traders View

From a Traders point of view, Price Action is such an invaluable concept that we as traders must grasp and get proficient enough to be able to see what the market is telling us and follow what the institutions are telling us – since there the one creating all the changes in price that you see. Take the time to read through an let us know if you have any questions. - Price Action Strategy like Professional -

|

| Price Action Strategy like Professional |

SIGN IN : FBS

As for an Introduction about Price Action:

“Your price action entry is just a piggyback trade on the institutions creating the price action.” – Al Brooks

You should always be trading in the direction of the majority of the institutional dollars, because they control there the market is going. Ninety percent of all trading is done by institutions and they are the ones creating the Price Action.- Price Action Strategy like Professional -

Follow what institutions are doing, if the markets are going up, buy as it’s going up. Don’t use to much logic, it does not matter if it seems counter-intuitive.

SIGN IN : FBS

When one decides to follow what the market is doing, it should be helpful to understand that computer generated trading accounts for 70% of the days volume that makes up the price action you see on your screen.

One of our mentors Al Brooks, mentions that if you are a day trader, ignore the news and look at the chart. Large patterns repeat over and over again such as trends, trading ranges, climaxes and channels. Focus on the absolute best trades.

Use a profit objective that is at least as large as your protective stop (your risk) and work on increasing he number of shares that you are trading.

Readmore : TRADING PLAN PRICE ACTION

EASLY MAKE MONEY FROM INTERNET

Price Action – Bar by Bar

A large part of Al Brooks (who we’ll quote alot throughout this website) and his 3 books are focused on individual bars to demonstrate how price action can significantly enhance the risk/reward ratio of trading – you cannot dismiss any bars as unimportant.

Learning price action is learning what the market is telling you, it’s time consuming but gives you the foundation you need to be successful trader. The goal of trading is to maximize profits though a style that is compatible with their personalities. - Price Action Strategy like Professional -

Price Action is a expression of human tendencies and PA is a manifestation on human behavior. Until human behavior changes, price action is still a valid way to trade markets. You need to be able to apply the knowledge of Price Action in a consistent way that makes money which is a very difficult thing to do.

Many traders take into consideration Candlestick chart patterns and all the fancy names that come with them, we do feel most of the names are largely irrelevant, they do help to give additional information on who is controlling the market which results in a more timely entry with smaller risk.

Famous technical analysis authors Edwards and Magee focuses and overall trend – Al Brooks and the other traders we’ll mention throughout this website uses same techniques such as trendlines/breakouts/pullbacks, but the more effective way pays closer attention to individual bars on the chart to improve risk/reward. - Price Action Strategy like Professional -

The most common and successful reversals first break the trend line with strong momentum and then pull back to test the extreme – Price Action is far more important than any information than any other information, and if you sacrifice some of what it is telling you to gain information from something else, you are likely making a bad decision.

On the road to being a effective and profitable price action trader is learning what discipline means and doing what you do not want to do. You need to be extremely flexible and go where the market is going and doing as it does.

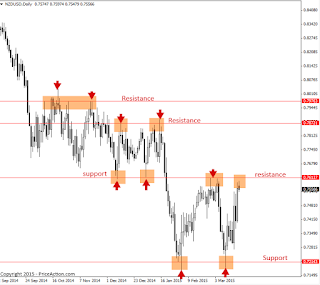

The most useful tools for understanding price action are trend line, Prior Highs and Lows, Breakouts and Failed breakouts, the size of bodies and tails on candles, and relationships between the current bar to the prior several bars.

In particular how the open, high, low, and close of the current bar compare to the action of the prior several bars tells a lot about what will happen next, and we’ll go into each one of these areas.- Price Action Strategy like Professional -

SIGN IN : FBS

One day a pattern will work, the next day it doesn’t – close is usually close enough when learning to trade price action. This is the art of trading and it takes years to become good at trading and learning to trade in the gray zone and you have to get used to operating in the gray fog.

Nothing is ever clear as black and white. Watching to see if Federal Reserve cuts rates is a waste of time because there is both a bullish and bearish interpretations of anything that the Fed does. What is key is to see what the market does.

We’ll go into all the subjects of Price Action that are covered in the corresponding sections of being a profitable trader. In the mean time, take a look around and get use to the common terminology of Price Action.

Source : Google , Youtube , Facebook

Keyword :

price action trading system pdf,price action indicator,price action indicator tradingview,how to master price action trading,price action easy indicator,price action strategy,price action setups,price action entry rules,How do you use a price action strategy?,Does price action really work?,Which is the best price action strategy?,What are price action signals?,

0 Komentar untuk "Price Action Strategy like Professional"